Preface: The following essay was written for my Business Policy and Strategy class, so excuse the formal language - it's supposed to mirror a report a consultant would normally produce for a client. The report details some of the problems I see at Twitter, and well as recommendations to fix those issues. The essay is divided into three main sections: a company overview, the issues, and my advice to fix them.

Overview

Twitter is a social networking service that launched in 2006, which was around the same time smartphones began to penetrate the U.S. consumer market. Unlike other social networking sites at the time, Twitter restricted users to sending short 140-character messages, called “tweets”, using SMS or the internet. Initially catering to technology enthusiasts and pundits, Twitter’s popularity rose when the founders advertised the service at SXSWi, a film and music conference filled with celebrities and prominent journalists. Explosive growth followed, leading the company to go public in 2013. As of July 2014, Twitter has approximately 275 million users and is competing with other social media companies for user attention. The company’s growth, however, has dramatically slowed in recent times, and it is no longer virally spreading. In addition, excessive administrative, infrastructure, and sales costs have cut deep into Twitter’s pockets, making the company post continuous net losses. The last, and perhaps most fundamental issue is the company’s unfocused executive team - one which does not understand its own service.

Issues at Twitter

Slowing Growth

The business model for social media companies is entirely immature. Strategies to increase user growth, for example, will not be found in MBA textbooks or undergraduate business school classes. Thus, social media companies must improvise, research, and develop strategies as they go. Thus far, successful social networks such as Facebook, LinkedIn, Instagram, Tumblr, and Twitter have spread and engulfed the world only through one strategy - growth. For each of these services, growth is achieved by signing up as many new users as possible. By definition, a social network requires users to provide any value to those same users, since a social network is nothing without its community.

Consequently, every social media company loves to brag about its growth statistics, and Twitter has not been able to do so recently. While the service reported 271 million monthly active users (MAU’s) in Q2 2014, year-over-year growth has been slowing for the past few years. For social media companies, this is anathema, and leads to eventual extinction because their business is entirely predicted on its users. The results of Twitter’s declining growth are twofold. First, Twitter will not be able to generate as much revenue, because advertisers are less likely to purchase ads on declining services. Continued slow growth will also necessitate Twitter to charge lower ad prices from these advertisers, further lowering revenues, in order to keep them from flocking to more successful, growing social networks such as Instagram and Snapchat. Second, less and less users are likely to join Twitter when they see that their friends are not on the service, which leads to a vicious cycle of continuously shrinking growth, followed by decline. Growth was how Twitter became successful in the first place, and how it continues to be a viable social network. The slowed growth in recent times is a dangerous red flag that may lead to the demise of the social media company, just as many other companies have faded before it.

Excessive Costs

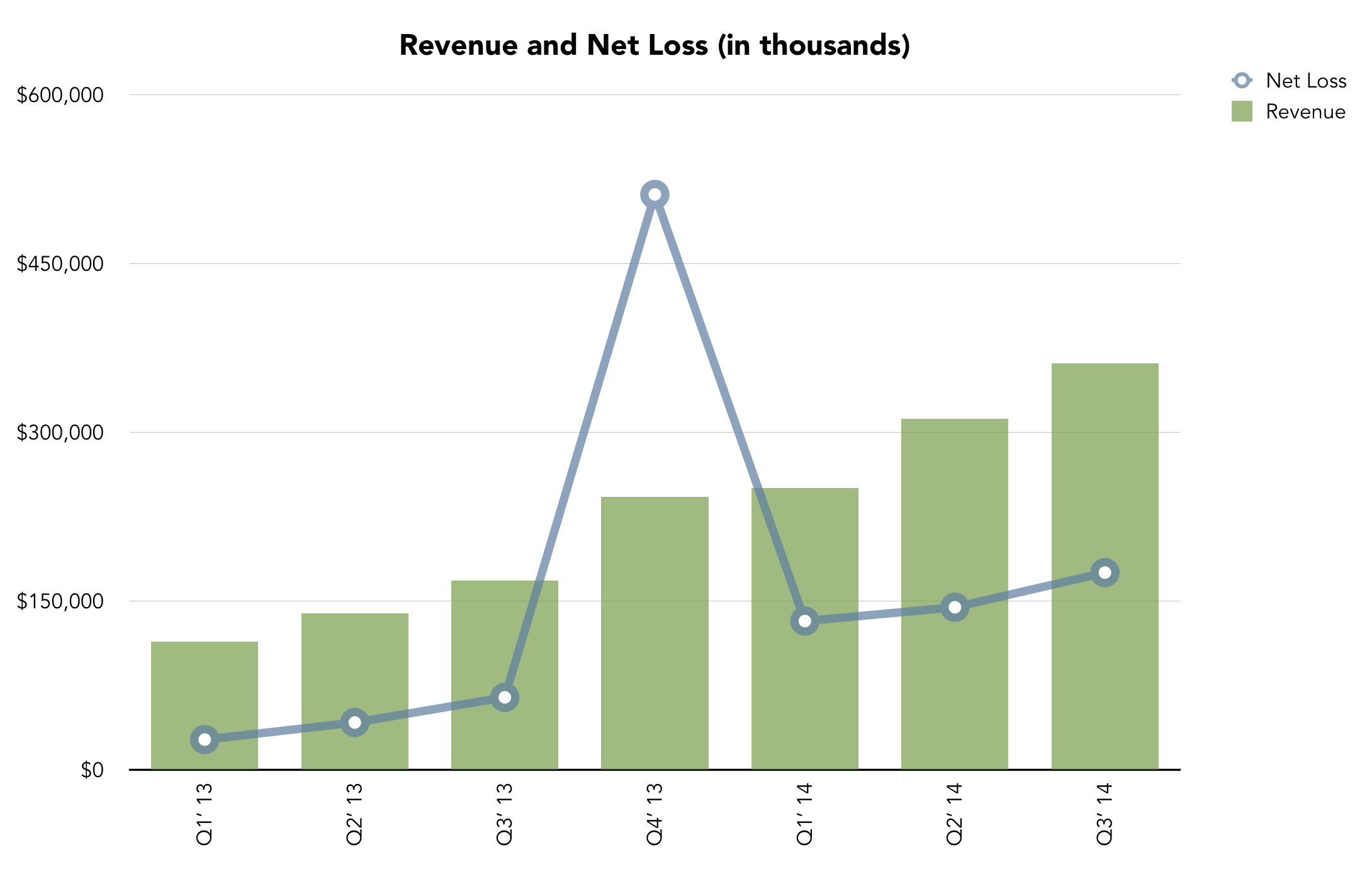

While it is true that profitability is an industry problem, Twitter is now a public company and must return value to investors. Those investors, however, have never seen Twitter post a profitable quarter since its IPO. Being a young company that only went public in 2013, many investors give Twitter the benefit of the doubt and expect profitability later. But as an industry analyst who follows the technology industry closely, I can assuredly say something is amiss at Twitter - and one must only look at their income statement. The company spent $1 billion in SG&A on a sales revenue of $665 million in 2013, losing more money on one line item than the total of its revenues. This is not at all surprising, as the company has been on a hiring spree, leaching designers and engineers from tech giants like Apple, Google, and Microsoft. Although this new talent is great, it’s extremely costly, as the company undoubtedly pays employees more than the tech giants to get them to leave for Twitter. It is normal for a company to increase SG&A spending as it grows, but costs should be scaled with revenues, which is simply not the case at Twitter.

Executive Team

Since inception, Twitter had a rocky road with its management team. Management turnover in the past four years is one for the books: the company started with Jack Dorsey in 2007, replaced him with Evan Williams in 2008, and again replaced him with the current CEO, Dick Costolo, in 2010. Besides the CEO position, most other executive positions similarly go through a lot of shuffling at Twitter. This butting of heads is not a good sign, implying that top leadership cannot agree on where to focus the company. Indeed, the company spent a record breaking $594 million on R&D, a 400% increase YoY, likely to find better ways to monetize the service and gain more users. As an outsider looking in, it appears that the executive team is not sure where to take the service, and is thus investing in R&D to find new outlets. This is hurting the company’s profitability, but also employee morale, which further increases employee turnover.

Advice for Twitter

Increasing Growth

The service that Twitter offers is truly exceptional, and is like no other social media service out there. Political revolutions have been platformed on Twitter. Whenever an earthquake strikes, you can be sure to hear about it on Twitter before any television news network. Musicians, politicians, and statisticians equally make use of Twitter, talking with their supporters and communicating their ideas in a public forum. The issue for Twitter is stuttering growth, which is the result of a confusing onboarding experience and a lackluster design.

When a new user wants to sign up for Twitter, they are presented with an awkward homepage that doesn’t clearly communicate the value proposition of the service. Once the user is registered, Twitter recommends he follow some popular accounts, from categories like music, sports, and technology. The result for the user is a timeline of tweets that does not actually fit the needs of the user well. This approach is fundamentally broken, and it is no wonder growth has been slowing, as the late-adopters cannot understand this ambiguous sign up process.

First of all, Twitter should redesign its homepage to better communicate its truly phenomenal service. The homepage background pictures should be removed, and replaced with a simple background, similar to the one Facebook uses. This will remove the clutter and bring focus to the site. Next, instead of three obscure sentences that describe Twitter, the designers should use bullet points; they are more succinct and easier to digest. Most importantly, the content of those bullet points should be the value proposition. Something along the lines of: “Twitter is where you get the latest news first. Twitter is where you talk to your favorite celebrities. Twitter is how share your experiences”. The goal of these simple phrases to create a tangible idea of how Twitter can be used by regular people, rather than the abstractions Twitter uses currently.

Twitter should also redesign its mobile applications for straightforwardness. Even as an experienced Twitter user, I find the current apps impenetrable in their design. Replies to other users should be designed to look like text messages, since that is what people are familiar with. In other words, replies should be viewed in a sequential manner and flow by time stamps. Most people use social networks on their smartphones, which is why applications are most the important element Twitter should get right. Redesigned applications, coupled with a simplified homepage will improve the onboarding experience and strengthen user growth.

Managing Costs

Twitter is a publicly held corporation, which means that shareholders expect to be paid back for their investments through company profits. These profits can also be reinvested into the business in order to build stronger competitive advantages like service uptime. As previously mentioned, Twitter spends disproportional amounts on SG&A expenses relative to its revenues, which results in a significant net loss every quarter. This is not a viable business strategy and must be quickly remedied.

While layoffs are never a popular option, that is what Twitter must do to manage costs. The company employs 3,300 employees, which translates to roughly 83,300 users per employee. For reference, Facebook, which is Twitter’s closest competitor, employs 6,800 employees, which comes out to about 184,000 users per employee. In the most basic terms, Facebook employees are roughly 220% more productive than their Twitter counterparts, which is a sign that Twitter needs to reduce its workforce. Just recently, Microsoft laid off 15,000 employees as part of a restructuring plan whilst growing revenues, so this method is not as drastic as it sounds. In addition to SG&A expenses, Twitter must also manage its cost of goods sold. This can be done by better scaling its infrastructure in order to reduce per-user costs. While this is an extremely technical undertaking, it is one that Twitter must commit to. As Twitter rolls out new features and gains more users, infrastructure costs will only increase, and the company must be able to scale its costscheaply.

Executive Overhaul

Dick Costolo has been the CEO of Twitter since 2010, and YoY growth and profitability have been declining with each year. Many industry analysts have been extremely critical of Costolo and his executive team, mostly because management is unfocused and unsure of where to take the product next. The most alarming sign of this executive myopia is the lack of dogfooding by leadership. I went through the Twitter account of each person on the executive team, and nearly all are rarely active on the service. This lack of dogfooding in top management indicates that they have little idea of what the service is and where to take it.

Consequently, the executive team should be replaced with leadership who actually uses the service on a constant basis, similar to how a normal user would. I would recommend the board of directors to begin this executive reshuffle by searching for a new CEO from within the company first, before looking for outside talent. Twitter has many extremely capable employees at the midlevel, some of which could easily assume the CEO position. Whoever this new CEO is, they must be an active user of Twitter and have a vision for the company. This new CEO must also choose new executive talent to replace the old, in order to help steer the company in the right direction. Again, inspiration for this kind of corporate overhaul can be found at another company, Apple. After assuming reins of Apple in 2011, CEO Tim Cook made major changes in the executive team, replacing the SVP’s of iOS, retail, and other major departments with leadership he saw fit. Apple has had record-breaking quarters since. Once Twitter’s management begins dogfooding its own service, they will learn what it’s like to be a normal user. This will allow them to better evolve the product according to user needs.

Coda

Twitter is a phenomenal service with an amazing potential that is mired by slowed growth, excessive costs, and a lackluster executive team. Fortunately, all of these issues can be fixed. Slowing growth can be reinvigorated by an improved onboarding experience as well as simplified applications that can communicate the Twitter value proposition better. Layoffs will be necessary to reduce SG&A costs and normalize the company workforce to benchmark levels. In addition, per-user cost of goods sold should be brought down through improved scalability, which is of key importance as the service attracts more users. Finally, an executive housecleaning should be made, instituting new leadership that is not only a user of the service, but also has a vision for its future. A company has little chance for success without a leader who can steer a company toward a specific goal.

These recommendations will turn Twitter into a profitable and successful social network. With a clear value proposition and redesigned applications, growth will rise again and may finally compete with that of Facebook. This will generate higher revenues, as Twitter will be able to charge higher prices from advertisers. In combination with a lower cost structure as a result of layoffs and scale, the company will finally be able to earn profits that can be reinvested into the business. This will only be possible with a new CEO and his handpicked management team, who will provide the company with a vision for the future.