Twitter: Introspective

Preface: This is the first of a new series of articles I will be writing, which are called Introspectives. For these types of articles, I will be doing some number-crunching and analysis, so that they are more in-depth and introspective (thus the name). They will include graphs/charts, followed by my thoughts on what the data shows. My hope with these introspectives is threefold. First, and with selfish intentions, I want to get better at data visualization and manipulation, and the best way for me to learn is through working with real data. Second, my hope is to share my opinions on what the data exposes, which the mainstream tech media did not pick up on. Finally, my goal for these introspectives is to create a narrative based on facts. In short, I want them to be strong enough to stand on their own.

The first introspective will be on Twitter, partly because it's the social network I use most, and partly because it's not doing so well. For me, it's exponentially more interesting to dig into unsuccessful companies than successful ones.

***

Income Statement Exploration

If you peaked into my spreadsheet, you would find a lot of work done on Twitter's balance sheet. While it's true that the balance sheet is fundamental to a company's analysis, it doesn't tell us much about the future potential, since balance sheets are snapshots in time. On the contrary, income statements represent data over a period of time (3, 6, 9, or 12 months), and provide us with more interesting information. Let's start with the basics: Revenues and Cost of Revenues.

- This is a fairly simple chart, showing us the revenues and the expenses required to create those revenues. It's a healthy sign when a company has higher revenues than cost of revenues (from hereon abbreviated CoR), which is indeed the case for Twitter.

- Notice how revenues and CoR began to divulge heavily starting with Q3' 13, which is when Twitter's revenue hit a growth spurt. Since social media is a young business, is it difficult to benchmark if Twitter's CoR is within industry standards, considering the industry is so young. You could compare Twitter to Facebook, or LinkedIn, but any differences wouldn't be an immediate cause for concern.

***

This next chart includes revenues and CoR, but it also incorporates other elements of the income statement, notably Research and Development, Sales and Marketing, and General and Administrative expenses.

- This chart is what Twitter should be concerned about. Total costs and expenses, which includes all of the above items, exceeds revenues by a significant amount.

- R&D is almost half as large as revenues. Twitter started spending a huge amount on R&D in Q1' 14, probably to search for products and services that could be incorporated into Twitter. We've seen Twitter Music (which failed), the ability to tweet multiple photos, and detailed tweet activity, among many other small additions to the service this year. All of these features are great, but they don't fundamentally add new use-cases to Twitter the service. This leads me to think that the immense amounts that Twitter spends on R&D could be toned down, which to their credit, they seem to have done in Q3' 14. We will see what happens to R&D spending in Q4' 14, but my advice is to slow it down, since results are unsatisfactory.

- The next highest expense on Twitter's income statement is Sales and Marketing, which is almost as high as R&D in Q3' 14 ($164 vs. $183 million). Here, I am not so confident that Twitter should reduce spending. It seems like S&M and revenues go hand-in-hand, since the company must advertise the service to advertisers (ironic, but that's how the online advertising business works).

- General and Administrative expenses make up the lowest costs, but they too have been steadily increasing. Again, it's hard to say if this item is too high or too low, but it's worth noting that executive salaries are placed in here. Given Twitter's gross management turnover, I would expect G&A expenses to increase in future periods.

- As I'm sure you noticed, expenses ballooned in Q4' 13. Without getting too technical, the explanation for this is Twitter's stock-based compensation expense, which accounted for $406 million in restricted stock units (RSU's). They expensed these in Q4' 13 in no doubt to gain some favorable tax treatment in future years, where losses could be used to offset any profits.

***

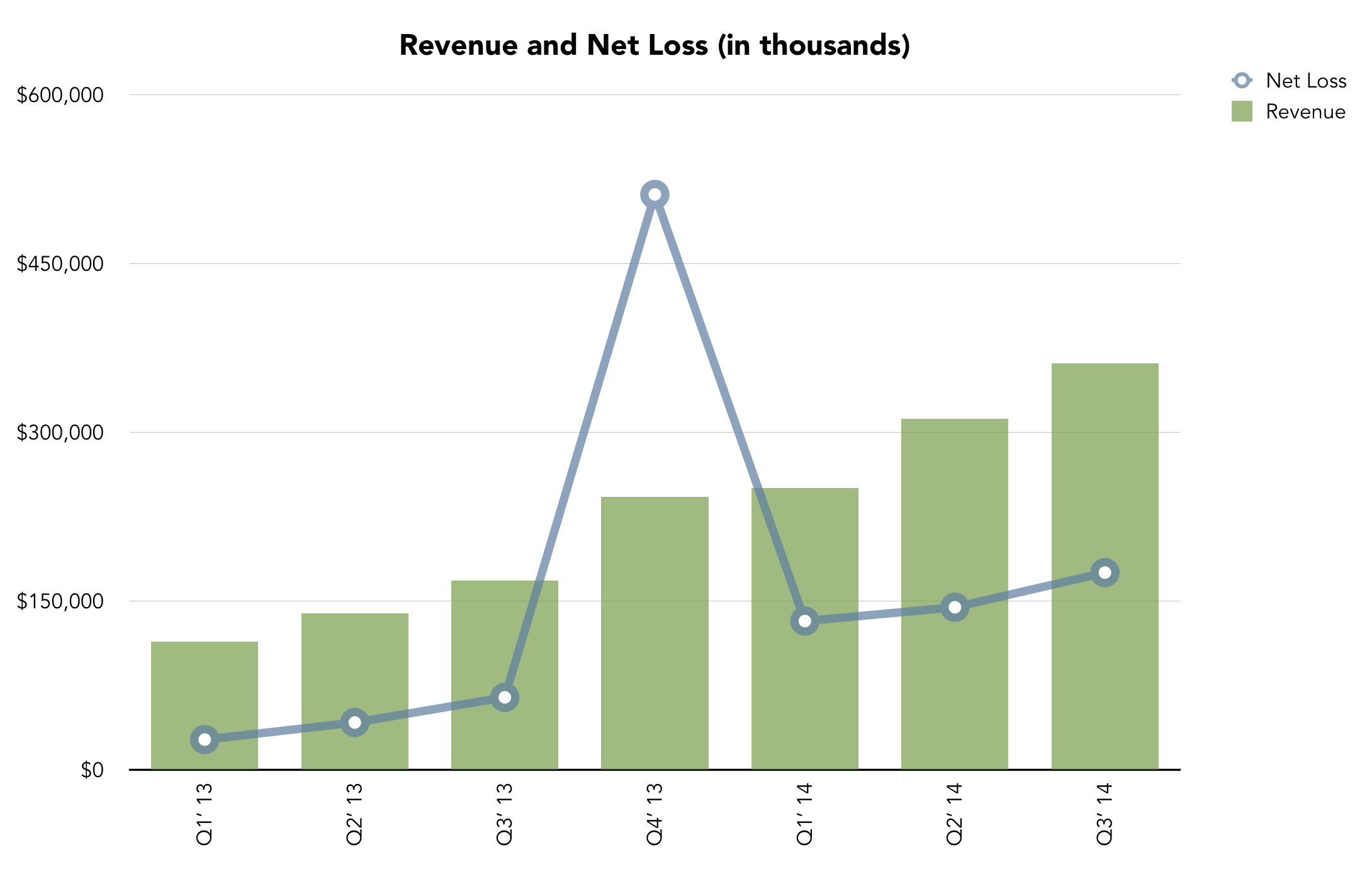

As a summary of the income statement breakdown, I've included a revenue and net loss chart that encompasses everything we've talked about previously. Some observations follow.

- Since Q3' 13, it looks like Twitter has been attempting to contain its net loss to half of its revenues. Management can spin it any way they like, but these consecutive net losses are worrying and don't seem to be stopping in the future. Twitter is either too costly to run, or it can't find enough revenue streams to offset the high costs. Or perhaps both.

***

Balance Sheets, Income Statements, and Narratives

As an accounting major, I can tell you it's very easy to get lost in the numbers, and forget about the big picture. While the details certainly matter (MACRS or straight-line depreciation), they don't tell us the true condition of a company. Think about the time you got a nice big juicy pimple on your forehead, which is extremely noticeable to everybody. Does this mean you have a life threatening disease? Of course not. But it may be a sign that you should cut back on that General Tso's Chicken you've been ordering every Wednesday night. At the very least, you know to skip the fortune cookie.

Similarly, the expenses we looked into previously (CoR, R&D, S&M, G&A) are extremely obvious to everybody, and lend themselves to be preoccupied with. However, they don't tell us the true condition of the company - they only explain half the story. The other half of the story, which in the pimple example would be the functioning of your immune system, is the company narrative.

Let's ease into the Twitter narrative slowly, starting with revenues, costs, and monthly active users (MAU's).

- Only one new piece of evidence has been introduced into this chart, and that is MAU's. Revenues and total costs are both dollar-sign items, while MAU's are an intangible, but equally fundamental statistic to the salubriousness of Twitter. What becomes immediately clear from this chart is that user growth is not in as rapid as revenue or expense growth. In fact, user growth is downright sluggish, especially compared to the growth of Facebook and Instagram (found later in this analysis).

- What Twitter has been able to do was to increase revenues much quicker than users. The goal of this analysis isn't to figure out how they've done it (although that is certainly interesting as well), but instead, the focus is on the future. At a certain point, there is a limit to what Twitter can charge an advertiser to place an ad on the service. That limit is monthly active users. Given the lazy growth of MAU's, revenues growth will eventually plateau to be in line with user growth. This is assuming that Twitter-the-service continues to be the main product for Twitter-the-company. Twitter doesn't have diversified income streams like WhatsApp and Instagram, which Facebook smartly purchased, so revenue growth is bound to hit a roadblock if nothing changes. One can only assume Twitter knows this, and is working on new products and services down the road.

***

Sometimes it helps to visualize the same data in a different light. Below is a chart showing MAU's and revenues, as well as a logarithmic trendline of the MAU's. Note the y-axes, which correspond to different data points.

- The MAU trendline tells the whole story. User growth started up rapidly, growing from Q1' 12 through Q1' 13, and then slowing down thereafter. I wasn't able to find revenues for that period of time, since Twitter was still a private company, but if Q3' 13 is any indication, revenues were measly - there were no public shareholders to please yet.

- It looks like there is some fanciful accounting going on in Q3' 13. As mentioned earlier, Twitter had a large stock-based compensation expense in Q4' 13, and I'm guessing they accelerated revenue recognition in that same quarter to make the loss look better. As a result, the next quarter (Q1' 14) had very little revenue growth. This is conjecture, of course, but accountants are known to manipulate revenue recognition like so.

***

Normally, I don't like comparing social media companies to each other. Social media is it's own industry, but it's too adolescent to benchmark companies against each other. Facebook serves needs that are different from Instagram, and the latter serves different needs than Twitter. That said, they are all social companies, so some sort of comparison is allowable. Comparing Twitter to Facebook/Instagram serves to further explain its narrative. It's also a great tool for getting a feel for the size of Twitter. With that, let's look at the MAU's of Facebook, Instagram, and Twitter.

- Facebook is king. Zuckerberg's company simply engulfs Twitter and Instagram (reminder: it's owned by Facebook), and it's so large that comparing Twitter to Facebook would be futile. It does tell us one thing though - Twitter is not Facebook, and it will not be the next Facebook.

- The story of this chart is actually lies with Instagram. Just recently, Instagram announced it has 300 million MAU's, which makes it larger than Twitter. To be fair, Instagram is primarily a photo sharing service, while Twitter focuses on 140-character text messages, but you can bet Twitter would love to have Instagram under its portfolio. If you recall, Twitter wanted to purchase Instagram, but likely got outbid by Facebook for it. Regrets, I've had a few.

- Analysts like to dig extremely deep into the details, but all we need to see about how Twitter is doing is right in this chart. Twitter's MAU growth was not able to match that of Facebook, and eventually, people realized Twitter is not Facebook and will never be as large as Facebook. Stock markets adjusted, and everyone moved on. Now Instagram, another product in Facebook's portfolio, outpaced Twitter's growth. The trajectory of Instagram shows it's going up, while Twitter's is slowing down and might even level-off. This doesn't make Twitter a bad company, it just signals that it will no longer be a growth company, which led investors to invest in Twitter in the first place.

- You're probably now thinking Twitter should be worried about Instagram's success. They should be worried insofar as to why Twitter can't match Instagram's growth rate. But I wouldn't worry about Instagram in the competitive sense, since they are two entirely different social networks. I haven't looked into the data, but I would venture to say that many people use both Twitter and Instagram (in addition to Facebook), and use of one service doesn't take away users from the other. I also don't see Instagram adding any functionality similar to Twitter, since the beauty of Instagram is its elementary simplicity. In short, Twitter shouldn't be actively preoccupied about Instagram's success, and instead focus on their own issues (of which there are many).

***

This final chart displays the same data as above, in a slightly different view. Note that there is no Instagram MAU's for Q1' 14 and Q2' 14, because Instagram didn't release this data to the public.

- It's easier to see by how much Facebook trumps both Instagram and Twitter in this chart. Facebook is huge.

- Q3' 2014 is when Instagram overtook Twitter. It's worth reiterating that this doesn't mean much in itself, it only tells us how successful Instagram was in growing.

***

Coda

As I was writing this introspective, I was faced with a conundrum. On one hand, I wanted to present my findings about Twitter. On the other, I wanted to give my advice on what Twitter should do to grow as a company. Since I have no higher body to report to, I chose to do both. Sprinkled within this analysis are my opinions, which I believe are good strategic decisions for Twitter. That said, the focus of this analysis was not recommendations, of which I have many. If you are interested in my recommendations, or just have a comment to add, feel free to contact me via email, or fittingly, by Twitter.

***

Download the PDF of this report: Twitter Introspective