Chart Dump: Apple 2Q15

The charts speak for themselves - another great quarter for Apple!

The charts speak for themselves - another great quarter for Apple!

People often mention the term well rounded to describe folks who are good at more than one thing. John is a biology wiz, but he also knows a lot about sports and plays basketball every week. John is also well educated in history, given his fascination with medieval Europe. We are all familiar with this term in regards to people, but I’ve been recently thinking how appropriate this term is for describing companies. For this post, we will be taking a look into a few well-known companies: Apple, Google, and Microsoft to see just how well rounded they are. I have picked three easily comparable criteria to gauge these companies by: design expertise, functionality expertise, and empathy (arguably the hardest characteristic to measure). These are three attributes that I believe substantially differentiate companies (unlike say, business models, which are necessary but not sufficient attributes), and are prime reasons for their success. This comparison only works when compared in relative terms; we can’t compare a tech company to a luxury car manufacturer since they solve different problems.

Apple

It is hard to argue that Apple’s design expertise is anything other than prudential. Apple products are renowned for their hardware differentiation. Competitors base their designs on the paradigm set by Apple, not vice versa. In terms of software design, I would argue that Apple is in the lead, but not by the country mile it leads in hardware.

A common complaint people have with Apple products is their lack of functionality. Functionality is an umbrella term for anything a consumer may want to do with the device. Mac OS X notoriously doesn’t have many games on the platform (although this has improved lately), iOS has no file explorer, and so on. Compared to the functionality Android and Windows offer, Apple devices are much more limited in functionality. There is nothing inherently good or bad about this point; the minimum functionality must meet the minimum functionality demands of consumers, and anything more can actually lead to confusion and dysfunctionality.

Finally, let’s talk about Apple’s empathy. What I mean here of course is how well Apple understands the needs, desires, and all that other gooey stuff of its consumers. An empathetic company is able to correctly predict what customers may want, and offer that amount in terms of functionality. Judging purely on the extraordinary success of the iPhone and Mac platforms, I would characterize Apple as an extremely emphatic company. In most cases, it accurately predicts the problems a user experiences, and solves them a way they can appreciate. The key here is to focus on the average user. Apple does not cater well to users on the outskirts, and nor does it attempt to.

Although Google was off to a slow start, their design expertise has improved dramatically in the last few years. Android is no longer the terminator OS from the future - it is colorful, friendly, and humane. Chrome OS is similarly playful, and appears to be improving rapidly. In fact, all of Google’s products are relatively well designed. In a vacuum, Google’s design is impressive, but it still had a long way to go to come near Apple. Google’s products are often difficult to navigate and are loaded with options (functionality), to the detriment of their design.

The functionality Google products offer is vast. You can do pretty much anything you would want to do with a computer on Android. Gmail has hundreds of different settings that you can tweak to your liking. Google’s portfolio of products and services is expansive; the term focus does not exist in Google’s otherwise complete dictionary. As hinted earlier, functionality is a blessing and a curse. Too little and nobody will use your product. Too much, and nobody will understand how to use your product. Finding the right balance is difficult. On average, Google provides more functionality at the risk of overbearing complexity.

Google has probably gotten the worst press on this last attribute, empathy. There is a long cemetery of services that Google has put to rest, mostly because they didn’t vibe with consumers. Most prominent such service was Google+, which was supposed to be a social network for Google users. It still exists, but Google has all but abandoned their quest for social. Many users are also increasingly wary of privacy and tracking, which goes against the nature of Google. Google makes money based on advertising, which itself requires user data. Google may understand that consumers value privacy on an intellectual level, but that does not change the company’s behavior in meaningful ways. Just as Apple thinks it knows design better than the consumer, Google believes openness is superior to privacy. There is no right or wrong here, there is only is and isn’t.

Microsoft

If you lived through the 1990s and 2000s with Microsoft products, you would know just how uninspired their design was. Nobody would ever call Windows XP beautiful (if one such person exists, direct them to me, and I will cover the eye doctor charges). That all changed with Windows 8 and the Metro interface, and has only been improving with Satya Nadella at Microsoft’s helm. The design may not be for everyone, but it’s undeniably opinionated and an improvement over prior Microsoft products. Microsoft began designing for consumers, not corporations.

Microsoft products have always been strong in their functionality offering. I don’t think you will find a person in the world who knows every single Excel function and feature - the same can be said about nearly every Microsoft product. More than Google, Microsoft classically aimed to appease the needs of every user, even if it made the product more difficult to use. Lately though, Microsoft has begun to strip functionality away, catering to the 99%, abandoning the 1% power user.

Microsoft has always understood the needs of enterprise users, but regular John Doe consumers were a mythical beast with unexplainable desires. Microsoft clearly understood the fundamental needs of corporations: collaboration, security and liability precautions, support, and product uniformity were all provided by Microsoft. These attributes, however, added almost nothing to ordinary consumers, who Microsoft all but abandoned. For this reason, Microsoft went down in history as being extremely empathetic to enterprise, and not at all to consumers. Full credit is again due to Microsoft for changing priorities so quickly. The new Microsoft is still enterprise friendly, but it now understands the need of consumers. Microsoft Office is available on every platform, it is free for practical purposes, and I dare to say that the apps are excellent.

Coda

Given the task of ranking Apple, Google, and Microsoft in these three attributes, I would define the following order.

Design

1) Apple

2) Google

3) Microsoft

Functionality

1) Google/Microsoft

2) Apple

Empathy

1) Apple

2) Microsoft

3) Google

Note that weights are not assigned to each attribute - not because the attribute doesn’t deserve a weight but because it requires further analysis (maybe in a later post). In other words, empathy may matter more than design, but how much more exactly is unknown to me at this time. We should also note that the rankings of each company changes through time. The above rankings are how I see the companies at the present time, not yesterday or tomorrow.

Feel free to comment and assign your own rankings in the comments section below. It would be interesting to compare what others think.

You will agree, my voracious reader, I am not a product reviewer. For this very reason, I mostly refrain from publishing any reviews of products I have purchased. That isn’t to say I don’t have strong opinions about those products (ask my friends, they will attest), but simply that I do not publish them on this site. Let us leave the reviews to our more adventurous writers. Instead, we aim here to understand the hidden complexities that are not often talked about in the contemporary technology and business press. On today’s agenda - the Apple Watch.

As you so astutely recall, I have written about a few scenarios the Apple Watch can take upon its entering the market. For your convenience, I have summarized those scenario below:

1) It can flop, and Apple will abandon efforts.

2) It can be a semi-successful product like the iPad.

3) It can be extremely successful like the iPhone.

Well, as of last week, the Watch became available for preorder, as well as up for display at your nearest Apple Retail locations. Of course it is still too early to tell which scenario the Watch will take, but as of most recently, I have thought of some additional complexities that will undoubtedly affect the success of the Apple Watch.

The Watch, and the Hierarchy of Needs

In a 1943 paper titled A Theory of Human Motivation, Abraham Maslow proposed a psychological theory called the Hierarchy of Needs (HoN), which aimed to describe the patterns of motivation us humans go through. Like any psychological theory, the HoN is imperfect and met with heavy criticism. Despite this, it is still commonly taught in most psychology classes and remains as well regarded as a theory may be. For your double-fold convenience, I have reproduced Maslow’s hierarchy below.

With this hierarchy in our retinas, let us begin to answer some questions. First, where do we think smartphones belong (note: there is no wrong answer, only more correct answers). If you asked your writer, he would answer that smartphones started at the peak of the pyramid (“Self-Actualization”), but have descended one level down to “Esteem”. As you descend down the pyramid, the importance of each step grows until you reach “Physiological” needs such as food and water. We cannot live without those items, making them of the utmost importance. Smartphones started at the top of the hierarchy because their utility went from little to great; their impact on our lives followed the same trajectory.

It is still possible to live without a smartphone, but increasingly, that life is not worth living. I jest, of course, but the importance and value of the smartphone in the life of the average human continues to grow with each new iteration. Deviation from the “Esteem” step, on which I currently place smartphones, leads to helplessness, a lack of respect, and to weakness. Imagine traveling to a new country without a smartphone. Most likely, you would get lost - Helplessness. Alternatively, what if someone told you they don’t have or cannot afford a smartphone? Would that person be given the same respect as a smartphone owner? Lack of respect. Finally, picture yourself doing a group project for which you need to Google something. Without a smartphone, you are helpless. Weakness.

If you are thinking these examples are cruel and not perfectly symmetrical to the real world, you would make a solid argument. But it is impossible to deny the rise of the smartphone in our daily lives, and its downward descent on the hierarchy of needs.

Are you hungry on the day the Dow Jones Industrial Average hits its peak for the year? Probably. What about on the day it falls eight percentage points? Still, you’re probably hungry. And if the market totally plummets, leading to a full-fledged depression. Still, you have to eat. Maslow’s HoN shows that the physiological and safety needs must always be met; the alternative is death. For this reason, companies in the business of selling food, water, and shelter are not as hard hit by the impacts of the economy. This is in stark contrast to companies in the business of selling luxury items such as cars, clothing, and perfume. The hierarchy of needs allows us to gauge the relative importance of these products in our lives, and how the economy and human tastes will affect them. The lower the product is on the hierarchy, the less affected it will be.

Let us circle back to the iPhone for a minute, which sits on the second to last step. In the case of a market downturn, do you think consumers would still purchase smartphones? Well, you might say, it depends who the consumer is and how bad is the market crash. Your answer would be precisely right. The rich and less affected would still upgrade their phones every year, as would the working middle class, since they would probably require the smartphone for work. It is entirely plausible, however, that the less fortunate, poorer demographic would eschew upgrading their phone this year. If things get really bad, they might even cancel their contract and go without a smartphone. And since the smartphone is on the second step, esteem, it would be hit less hard than the products at the top of the pyramid, self actualization. It isn’t too hard to imagine a future where smartphones will descend further down the pyramid, into love and belonging, and thus be further insulated from any market movements.

Finally, we have arrived to the point of discussing the Apple Watch, and where we think it fits within this hierarchy. We can quickly dismiss the Apple Watch from the physiological, safety, and love/belonging steps, since it is not necessary for survival, safety, or belonging. That leaves us with esteem, and self-actualization - the least fundamental needs a human being requires. As you recall, I placed the iPhone on “Esteem”, which is the second to last step. I now ask you to pause and think for your own, omnivorous reader: where do you think the Apple Watch belongs? Once you’re done, return your gaze here and let us continue.

If you placed the Watch in the “Esteem” tier, you expect to be provided with the same value, utility, and prestige as the iPhone. Otherwise, you chose “Self-Actualization”, placing the Watch on the top tier of the hierarchy - a tier which supposedly results in the realization of a person’s full potential (who knows what that means, exactly?).

Despite the cryptic definition of “Self-Actualization”, your dear writer believes the Watch fits in this tier. The utility and cultural value of the smartphone reaches far wider than the smartwatch (at this time); in most developed nations, you will not find many people without a smartphone. The Watch, as it exists today, is a luxury item assembled for prestigious wrists. It is a fashion statement just as much as it is a fashion accessory. The value it provides is ancillary to the value of the iPhone. Alone it does little. If you’ve got food in your fridge, a house and a spouse, respectful co-workers, and a smartphone, the Watch is the last remaining step to your actualization. It does not come before those items, however.

If you feel philosophically enlightened from our discussion of the hierarchy, I hope too you will also feel logically and realistically liberated soon. Given our placement of the Watch in “Self-Actualization”, it is the least critical element to our existence. As such, it is a product that is least insulated from market movements. If an economic disaster were to strike, the Watch would be the first product to have its sales hurt. Therefore, the future success of the Watch is heavily correlated with the movements of the economy; when the economy slows, Watch sales will slow. When the economy speeds up, Watch sales will follow.

The Watch, more than any other product in Apple’s portfolio, sits highest on the hierarchy of needs. It is simultaneously the least fundamental and the most desirable product a person can dream of. Consequently, Apple Watch sales will be predicated upon the buying power of consumers - which itself is derived from the economy - more than any other product Apple has recently released. And that, my friends, is as close to a product review as I will come to.

In Parts I and II of our Automotive Industry Exploration, we took a look at the revenues and costs of some of the largest players in the automotive world. We found that industry profits are quite low compared to those Apple is used to, mainly due to the intense costs of manufacturing a vehicle (materials, labor, equipment, etc). We also noted that if Apple were to enter the business of manufacturing cars, they would need to introduce some new technology into the equation. That new technology could come in the form of production efficiencies, new use cases, or something we cannot currently surmise. If not for this missing piece, Apple would be just like every other car manufacturer - high revenues, high costs, and average margins. If that doesn’t sound enticing to you, you might be right. It probably isn’t (for you and Apple).

For Part III of our exploration, we will be delving into the unit sales of the car manufacturers we visited previously. If you are like me, your best educated guess about which car brand is the most popular came from what you saw on the streets of your city, which may not be the most accurate data. After comparing the unit sales of the car manufacturers, we will dive into the unit sales of only one company: BMW. This choice was made for a few academically valid reasons. First, BMW is my favorite car manufacturer. Second, they gave the clearest breakdown of unit sales by car model (1 Series, 2 Series…). Third (and perhaps most arguable), out of all the car companies, BMW is most like Apple. They value design, they make premium products that are still affordable by most of the middle-class, and finally, they sweat the details. Part III will be the final post in this three-part series on the automotive industry as a whole. In future posts, we may explore some car companies independently (Tesla, Daimler, Volkswagen) and in greater detail, as well as keep a tab on what is happening with the Apple Car.

Big Picture: Automotive Industry

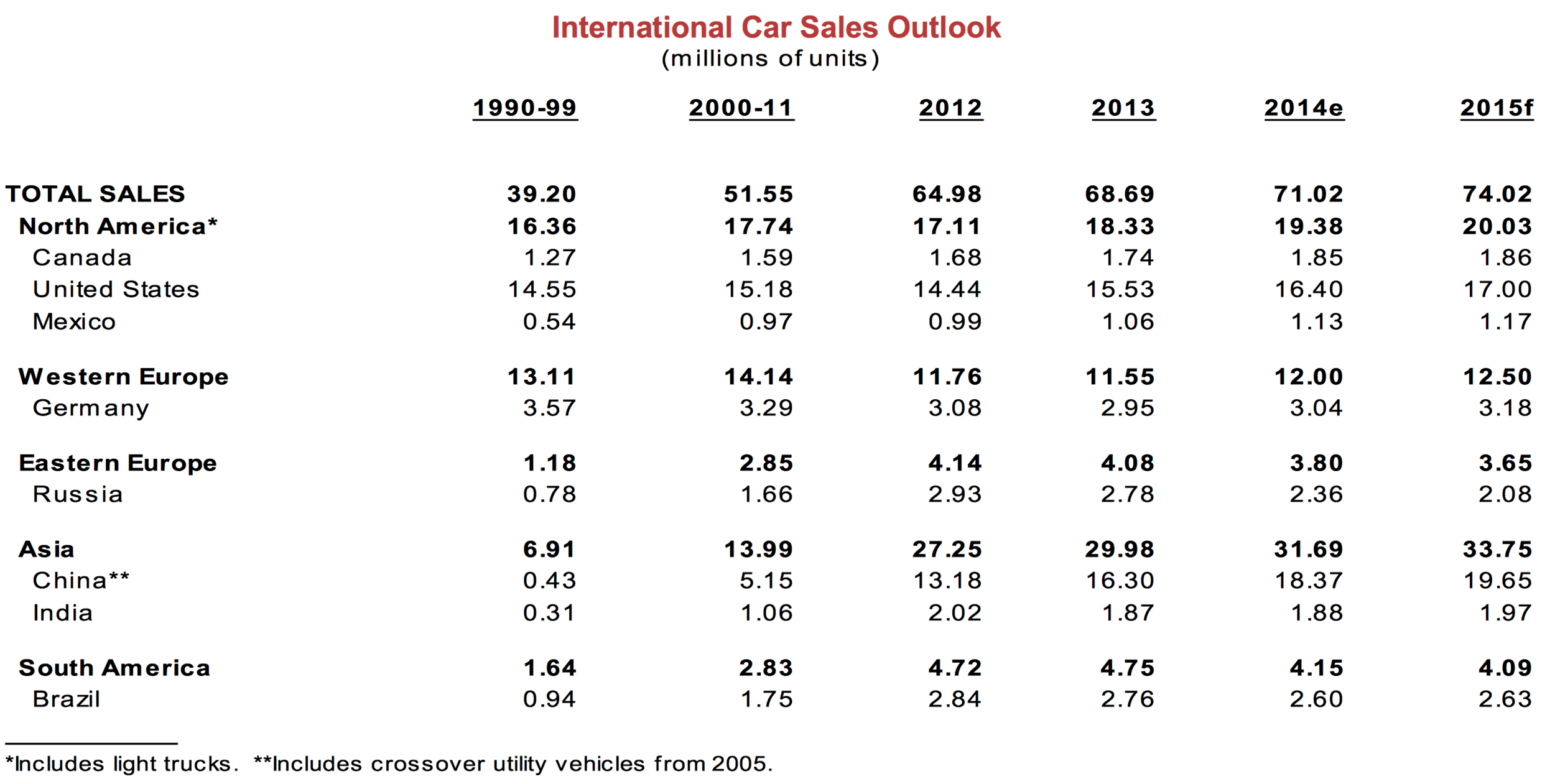

The companies in this chart sell roughly 60% of all the cars sold in the world. Estimates of global car unit sales range from 72M - 84M in 2014, and this chart covers 48M of those sales, hence 60%. If we assume the world population is 7 billion, then we can say that around 1 out of every 100 people buy a new car every year. In reality, that statistic is lower, but the thought is nonetheless intriguing. Some other points:

Small Picture: BMW

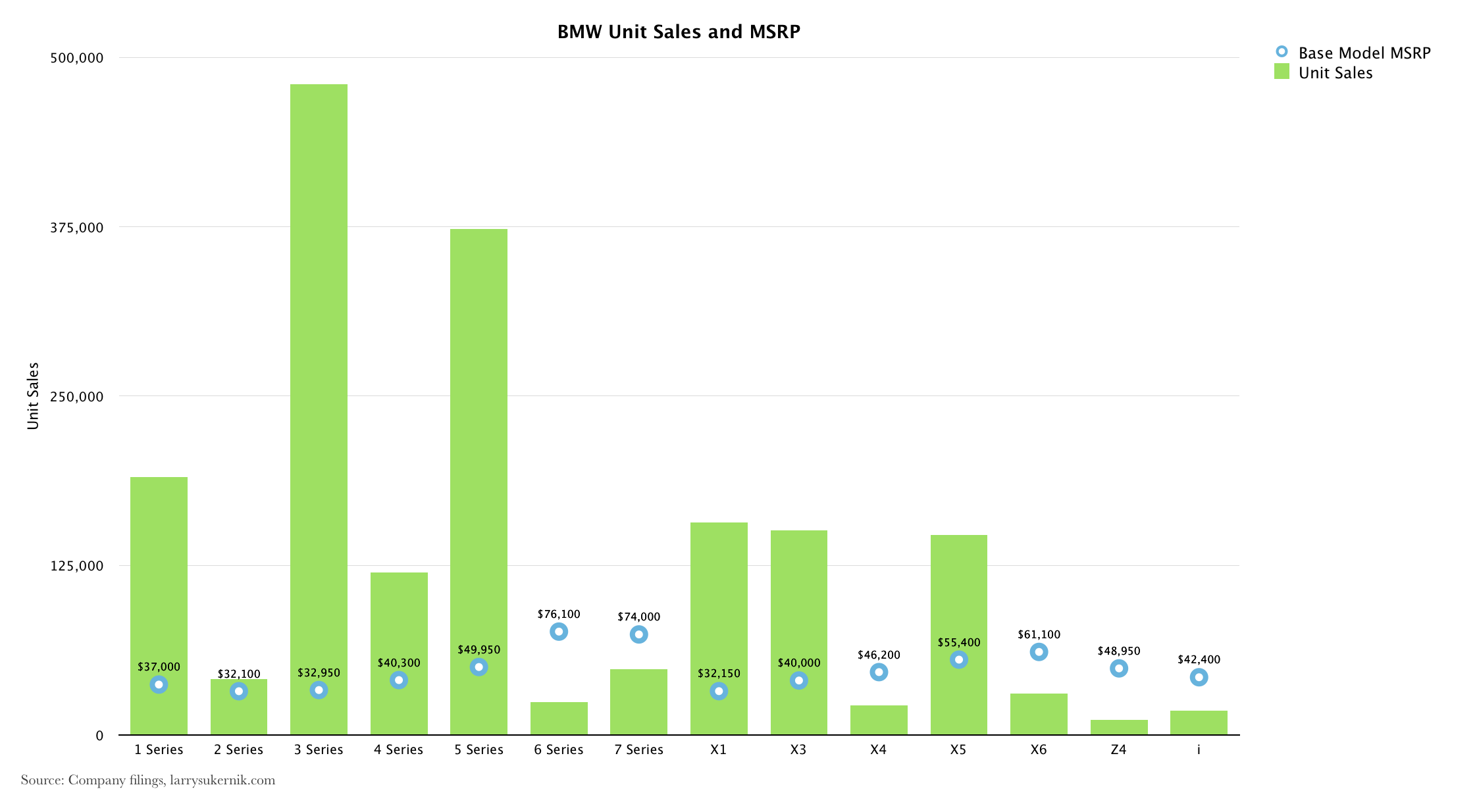

In total, BMW sold 1.8M cars in 2014. The above chart gives us a breakdown of those unit sales, model by model (BMW uses the word “Series” in substitute of model). A few things stand out in particular:

This chart is the same as the last, but it adds one additional detail - the base MSRP of each BMW model.

Coda

Overall, the car market is a competitive and somewhat unfriendly place to do business. If you had billions of dollars lying around and were interested in starting a new business, it is doubtful the automotive industry would be it. The profits are decent, but the costs and barriers to entry are huge (but not insurmountable, as Tesla has proven). Moreover, not that many cars actually get sold every year (around 78M). If you want to compete in this business, you’re not going to make much money using economies of scale, since margins aren’t good. The best way to make money in this industry is to be extremely efficient (Toyota, Honda), or to charge premium prices (BMW, Daimler). Even the efficient brands manufacture premium versions of their vehicles: Toyota makes Lexus, and Honda makes Acura. What you don’t want to be is Ford, GM, or Chrysler, which are neither efficient nor have successful premium brands (Lincoln and Cadillac barely qualify as such). As our previous analysis has shown, the American car companies are some of the least profitable car companies around, so replicating them is a fool’s errand. You can, however, make a healthy profit selling premium cars, as BMW has shown us.

So let’s return to our original question: what would Apple gain from entering the car market? In short, not much. Our three part analysis has shown that the automotive industry isn’t nearly as profitable as consumer technology. Of course, profits aren’t everything, and Apple’s goal when entering into the automotive industry could be a nobler one. But you would be hesitant to spend dozens of billions of dollars on a business that won’t return them to you. For this reason, I have come to the conclusion that Apple will not enter the car business as it exists today. If they do enter, it will have to be with something totally different. We’ve touched on what that difference could be in Part II, so I won’t go into that here, but it cannot simply be a superior version of a gas-powered car. Success might come from a place Apple has been before: Think different.

For next week, we will explore some strategies Spotify can take to combat the impending Beats (by Apple) release.

If you have anything to add, or just want to share your meandering thoughts about what we covered, please comment below! I’m also very active on Twitter, so don’t hesitate to @lsukernik me!

It is no secret that I am fascinated by Apple and the technology industry as a whole. I have written amply about Apple and the neighboring technology industry for the past few years (and have read about them for almost nine years now). When news broke that Apple was working on a car, my Twitter timeline was evidence of my not knowing of what to think. Although I don’t follow the automotive industry as closely as tech, I am a fan of cars and car design. I know when the new car models are released, what they look like, and what features have improved over the previous models. What I don’t know, however, is how the automotive industry operates (who are the suppliers, what materials are used, and so on), who the key players are, what the market share of each key player is, competition in the industry, and how profitable the automotive industry is in general. When I began following the technology industry, I didn’t know any of the above questions either, but through time I developed a thorough understanding. It is now time for me to develop an understanding of the automotive industry, which seems ripe for disruption.

If you’re reading this, I imagine you are in a similar boat to mine; you follow the tech industry closely, and have a newfound interest in cars after the recent Apple Car rumors. In the next few months, I will starting delving into the auto industry (in addition to the usual tech posts I publish) to gain a better understanding of it. Some questions I want to answer early-on are: what would Apple gain from entering the car market, how much profit is in selling cars, and what are the unexpected consequences of entering a wholly new market (in addition to many other questions). So sit down, buckle up, and enjoy the ride.

Global Car Sales

Automotive Industry Profitability

I chose some of the better known car manufacturers for this next chart, just to compare them to Apple. Academically, it is wrong to compare a company in one industry (tech) to another (auto), since two the industries are different in almost every regard. That said, doing so establishes a nice sense of scale which can help us understand the relative sizes of the companies. It may also help to answer why Apple may be interested in making cars in the first place.

Early Thoughts

While the above analysis was rudimentary and not enough to paint an accurate picture of the automotive industry, it is a good start at understanding the size and profits of the automotive industry. In a nutshell, here’s what we can takeaway:

Slide Gallery