Can Bitcoin Serve as a World Currency?

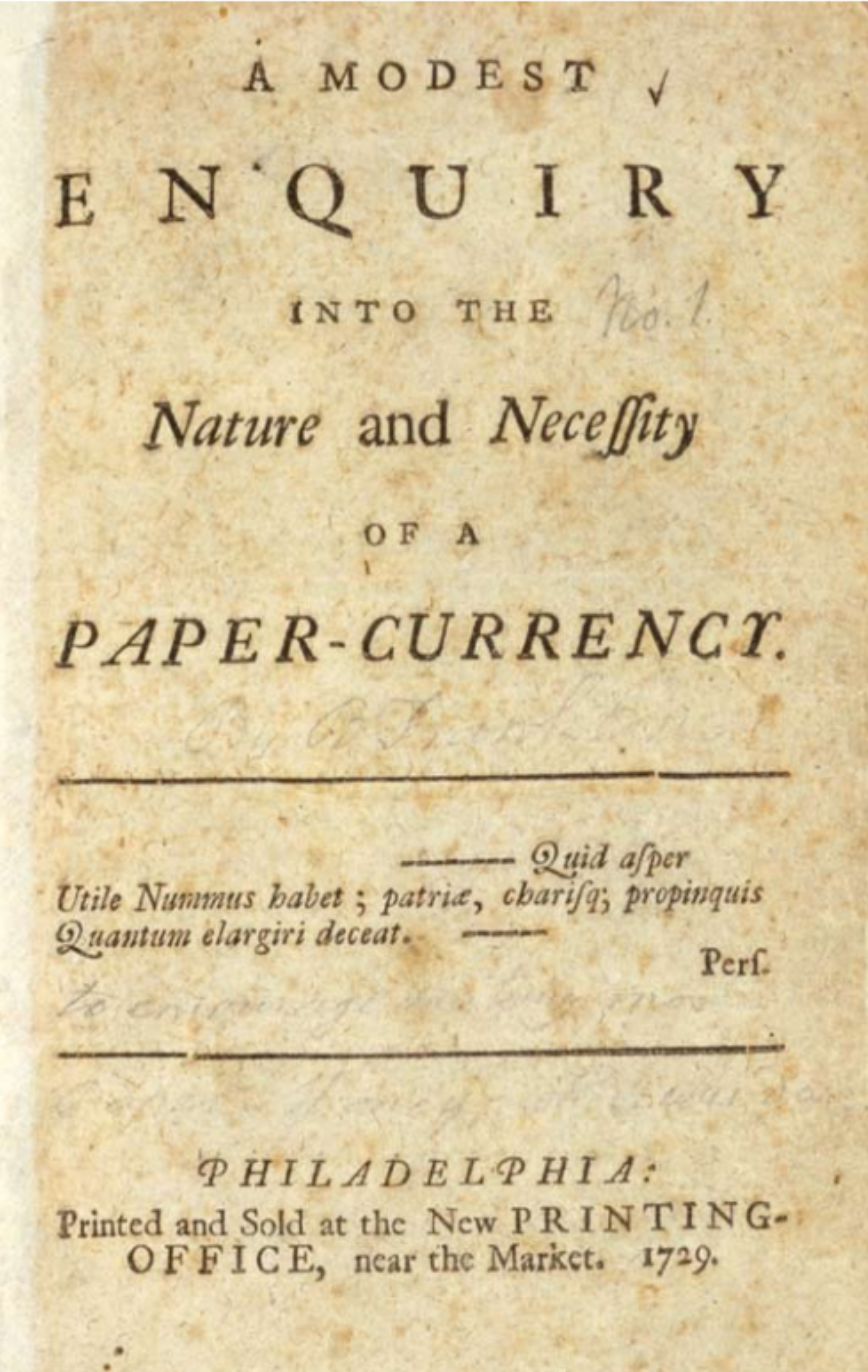

More often than not, Twitter ends up being a malapropos use of time given the noise to signal ratio. But every once in a while, a gem surfaces to the top. This post is the direct result of a pseudonymous personality on Twitter that put me onto an essay written by Benjamin Franklin in 1729. The essay was penned as The Nature and Necessity of a Paper-Currency; the ideas it expounded had me thinking all weekend, and so in typical fashion, I needed to get them out in a piece of my own. Before we begin, however, I want to call attention to a nota bene: I am a novice in the topic of monetary systems and currencies, so advance apologies if the topics we are about to discuss are elementary in nature. My goal is to understand. To do so, I rely on the classical art of putting abstract thoughts into written text. I leave it to you then, my attendant reader, to correct me where I am wrong so that hopefully in the future, I am no longer.

Bitcoin, the digital asset that gave birth to blockchains, cryptocurrencies, and ICOs, has a fixed supply. In total, there will only be 21 million bitcoins. At the time of this writing, roughly 16.5 million bitcoins have been mined, leaving us with 4.5 million bitcoins to be mined in the future. Without getting into the specifics of mining inflation, let us take these facts and proceed to thinking about whether bitcoin can serve as world currency (for the remainder of this piece, we refer to bitcoin the asset rather than Bitcoin the protocol). To do this, we will rely on first principles thinking, resorting to little to no source material. We will use source material for hard facts, but not for ideas, as we will want to develop the latter from the former.

Many supporters of bitcoin believe that it can serve as a worldwide currency. They believe it can transcend artificially constructed geographic borders and create an un-seizable, censorship resistant (the key word is resistant, not immune), and peer to peer digital currency that no centralized institution can control. 21 million bitcoins will ever exist; no fewer and no more. In this world, irrational and corruptible humans cannot manipulate the fixed supply. If you own one bitcoin, you have full confidence that the supply of bitcoins, and thus denominator, will never change. This is an extremely noble goal, and one that the population of the world certainly deserves. Upon reading the aforementioned essay, however, I no longer think bitcoins can serve as the currency for the world. To understand why, let us turn to the arguments laid forth by Benjamin Franklin.

In the essay, Franklin argues that scarcity, or a fixed supply, is not a desirable attribute of a currency. His logic is refreshingly simple, unlike many arguments used by cryptocurrency enthusiasts. And in my experience, logically simple arguments usually make the most sense.

While Franklin artfully constructs his reasoning, let us attempt to understand, using clear, modern English, why a scarce currency is not an ideal currency for society. To begin, let us construct a world that uses a scarce currency. In this world, you can buy items and pay for services using a scarce resource with a fixed supply — bitcoin. In our mythical world, wealth is measured by how many bitcoins you own. It follows, then, that in order to increase your wealth you need to increase your holdings of bitcoins. Using simple math, the amount of bitcoins you own is the numerator, and the fixed supply of bitcoins is the denominator. If today you hold 1,000 bitcoins (1,000/21,000,000 of total bitcoins), your wealth would increase if you held fifty additional bitcoins (1,050/21,000,000 of total bitcoins). Wealth is dictated by your ability to amass currency.

In this world of fixed supply, in order to increase wealth you are incentivized not to part with your bitcoins. Selling or exchanging bitcoins for another asset would only decrease your numerator, and thus your wealth. In the early days, let's assume that 21,000,000 bitcoins are evenly distributed to a world with a population of 21,000,000. In other words, each person gets one bitcoin. Distributing a fixed supply is simple enough, but making sure each person has the same productive capacity is not.

As time goes on, certain people may want to exchange small amounts of bitcoin for food and water. Over time, those with the ability to supply assets in demand (such as food and water), will have more than the one bitcoin since they have not parted with their original distribution. That is because these productive citizens now own the original bitcoin they received and the bitcoins they received for the assets they exchanged. They have used their productive capacity to create value — food and water — in exchange for bitcoins. We can dictate how many bitcoins will be created and how they are initially distributed, but we cannot force everyone in the world to have the same productive capacity. In short, wealth will aggregate with those that create more than they consume.

The logical conclusion of this experimental world, then, is those with productive capacity will convert the value they created into bitcoins. And since there is a fixed supply of bitcoins, a productive individual will not want to part with her bitcoins. There will be some folks, however, who need bitcoins in order to become productive, such as when they want to build a factory to product food. To build that factory, these folks will need to borrow bitcoins from those who have bitcoins to lend. Lending, however, is a business like any other. As such, there is a transaction cost to lending; this is commonly known as an interest rate. Those who lend, then, will eventually receive the initial amount of bitcoins they lent in addition to the bitcoins they earned from charging interest. Their numerator has now gotten even larger.

Wealth has now aggregated with a select few hard working and forward thinking individuals. These individuals are now able to command the rest of the population who were not as hard working and forward thinking, or whose elders were not as hard working and forward thinking, and thus did not leave an inheritance.

In this piece, the initial process of bitcoin distribution to wealth aggregation went by relatively quickly. But in a real-world scenario, this process would most likely take hundreds of years. The first hundred or so years may seem rosy, as bitcoins are relatively well-distributed. But down the line, the effects of productive capacity multiply, leading to extreme wealth aggregation. Those who want to store their wealth in bitcoins will be able to do so with ease. But those who want to attain wealth will have a much more difficult time since they can only reach productive capacity by borrowing bitcoins for a fee denominated in bitcoins. Thus, the only way to increase your wealth, if you started with nothing, is to have a productive capacity that exceeds the rate of interest bitcoin lenders charge. Should you be able to do so, you would become a wealth aggregator yourself.

And so, you now see why I believe a fixed supply (scarce) currency may not be in the best interest of society. There may be another digital asset that can serve as a world currency, but it will need to have an adjustable supply in order to counteract the effects of wealth aggregation.

The goal of this piece was to set forth an argument as to why bitcoin is not ideal to be a world currency. I explicitly did not comment on its other use cases. I have no plans to sell any bitcoins I own and remain confident in its ability to store value in a censorship resistant way.

As I mentioned at the start of this piece, I am fully outside my circle of competence in discussing monetary systems and currencies. I am, however, very open to learning more about the topic. To that effect, I highly encourage you, dear reader, to make comments, send relevant reading recommendations, and for truth's sake, endeavor to impartially debate the topic.