Some Spotify Charts

Sometimes it’s helpful to turn data into another medium. It is easy to get lost in the numbers, so I often find it helpful to view the information from a distance. Charts are great for that. I am still working on my Spotify analysis, but here are some preliminary findings. I will show the chart first, followed by my thoughts.

- As I have previously calculated, Spotify’s monthly growth is around 3.738%. We don’t have enough data to tell if this is a rapid rate, since no data is available from competitors. That’s why we can only compare Spotify with itself, at least for now. Paying subscribers are growing at nearly the same rate as active subscribers, which use the service for free. I would have predicted that free users would be growing much faster than paying subscribers, but the data seems to show this isn’t the case. Currently, roughly 25% of users pay for Spotify. This seems a little too good to be true, but I assume Spotify would like to convert even more users into paying subscribers.

- Revenues and Cost of Revenues are an extremely basic measure of profitability. In fact, these two data points sum only to give us Gross Profit. That said, they are arguably the most important indicators of growth and scale. Revenue tells us growth, while Cost of Revenue implies scale. Spotify shifted from a negative Gross Profit in 2010 to a positive one in 2011 and on. In short, this means that Spotify is making more money than it costs to power the service (without taking into account R&D and SG&A). Many startups have higher Cost of Revenues than actual Revenues, implying that they are not operating at scale. Spotify is still not profitable since the company isn’t posting Net Profit’s, but it appears to be running efficiently, as far as most startups go.

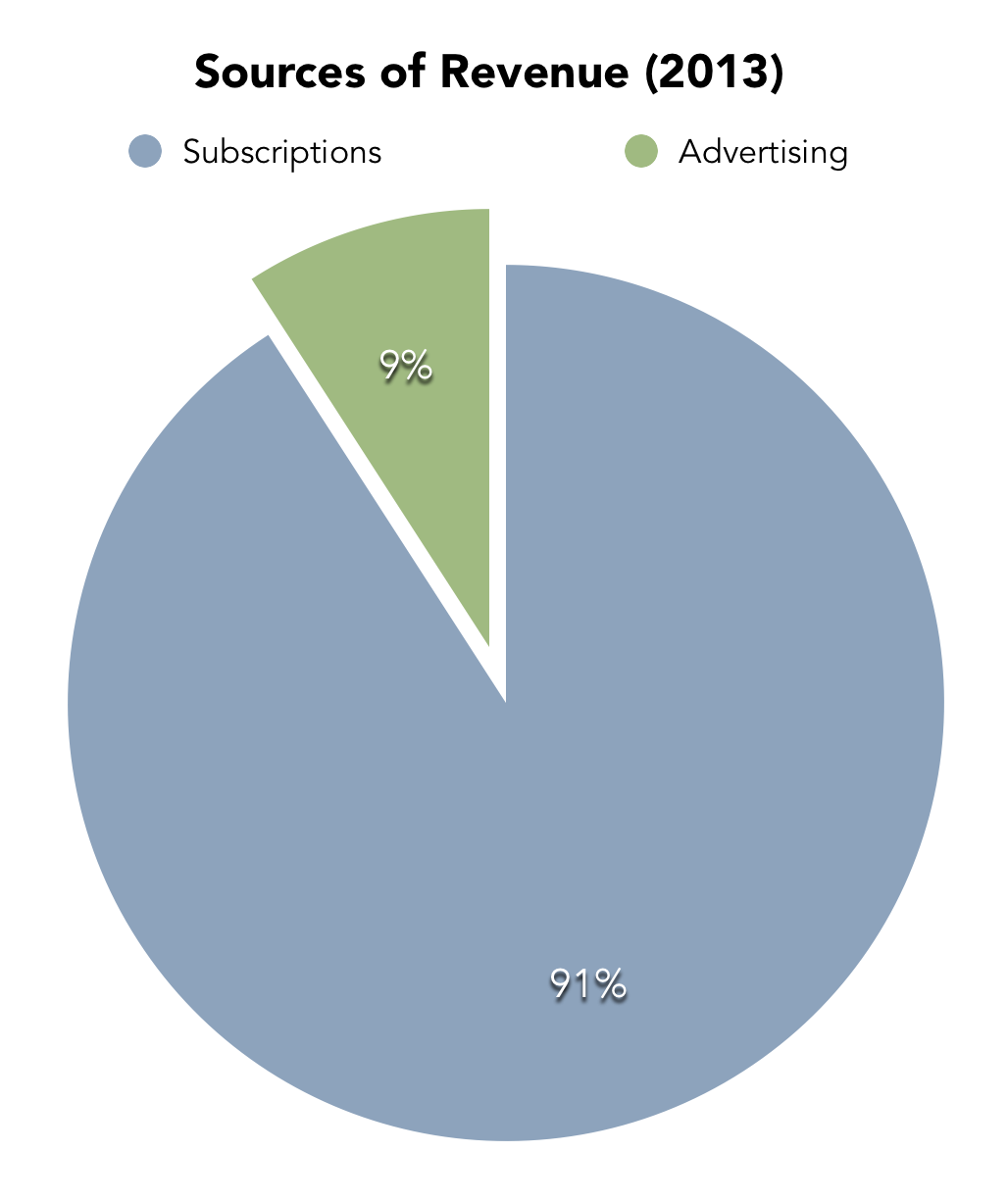

- 91% of Spotify’s revenue comes from subscriptions, while a measly 9% comes from advertising. This is a paltry amount, considering that 75% of users are free users. It makes you wonder how little Spotify pays out to artists for every play a free user makes. No wonder many musicians are hesitant to put their music on Spotify - it barely pays.

I often like to gauge a company’s future success by a simple question. Would I invest in it? Currently, Spotify is unprofitable, but if they can spread their costs over an increasing amount of paying users, it’s very likely that Spotify can turn into a profitable business.